Focus on B2B

Defining Enterprise B2B

A company is active in Enterprise B2B when the customers they are serving are primarily large, often international companies.

Note that for StartUps or even ScaleUp companies, this means that their customers are typically 100x or even 1,000x larger than them. It’s easy to imagine how this imbalance brings challenging situations, e.g., during discussions or negotiations.

Some aspects will also apply to B2C products but there are a number of significant, and important, differences:

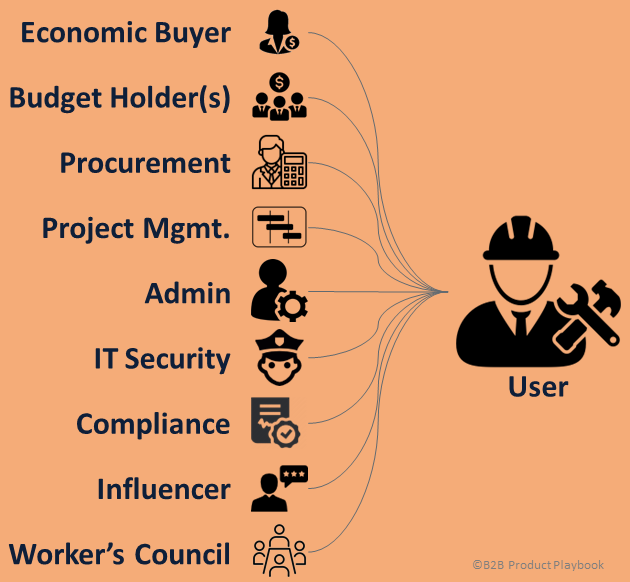

Buyers ≠ Users

In B2B, there is typically a group of decision makers and budget owners (most likely the management), maybe even additional gatekeepers (e.g. the legal or the IT departments) who will be different from the actual users.

Often even a central procurement is involved who mostly manages the actual purchase but are neither business leaders, sponsors, nor users.

Still, all these groups have needs that have to be taken care of: the strategic impact that the sponsor of the project is dreaming of as much as the simplicity and efficiency the users demand.

To keep all groups happy, their needs have to be addressed during Product Discovery. Also, it’s helpful to have regular alignments, product sessions and organize Customer Advisory Boards and similar co-development activities.

Most Businesses are Risk-Averse

While single users of a B2C app are quite willing to just try new things, most businesses have a strong tendency to avoid risks and have a rather low risk tolerance. They prioritize safety and business continuity over potential chances for new markets or game-changing technology.

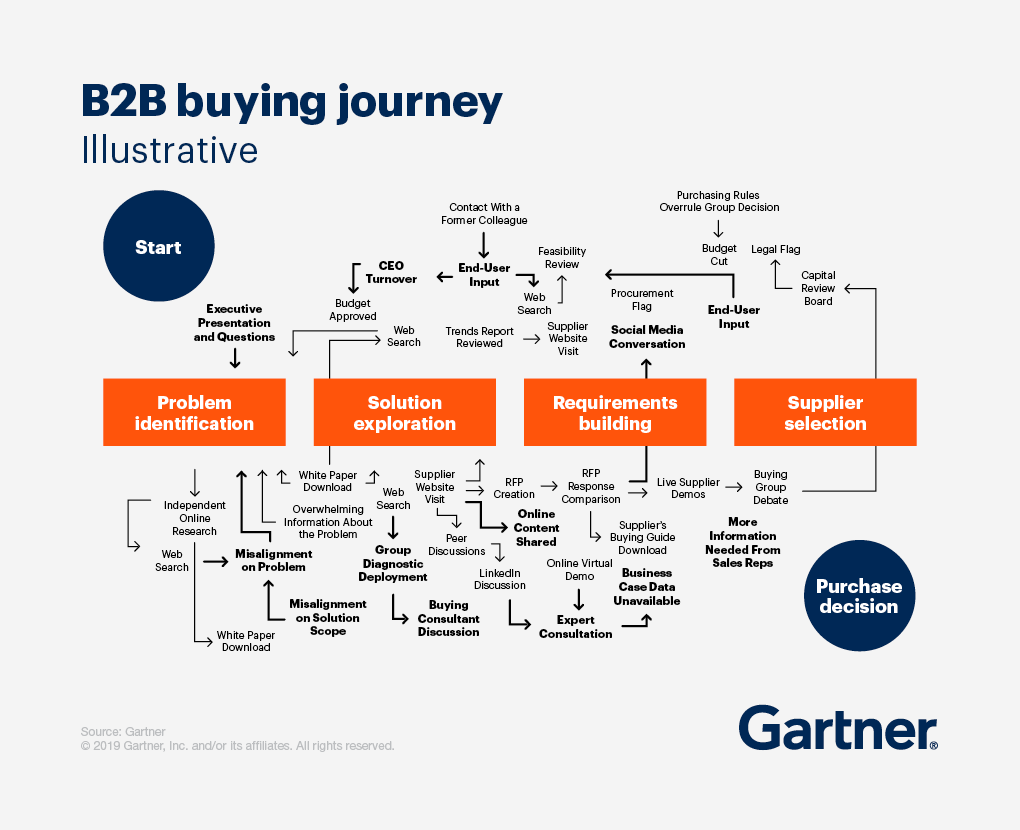

Complex Buying Process

Sales in B2C is often very quick, direct, and low-budget. The buyer is also the user, it’s often an easy and low-risk decision, ideally even with a plan that allows free trials or otherwise short cancellation periods.

In B2B, sales cycles often are 6 or more months which means there is no immediate effect or feedback on a feature or product release but rather a substantial delay.

On top of that, aspects that are beyond the control of the product vendor might emerge: Is there a general budget cut that stops the entire project? Did the project sponsor just leave for another company? Or does the global headquarters force all business units to implement a specific tool or vendor?

What’s more, typical B2B products require deep integration with other tools, such as the existing ERP, CRM or HR systems. Interfaces to these must be provided. Also, in enterprises many stakeholders and gatekeepers care about aspects such as compliance with official obligations as well as company policies, security in terms of IT as well as security of their investment, integration aspects, operations, SLAs, etc. In other words, while consumers quickly buy products by paying via their personal PayPal account:

No enterprise company is buying a global CRM with their credit card.

Enterprise Sales Team

Product-led growth is a new trend, originating from B2C but more and more also being applied to B2B.

Product-led growth is a business strategy that relies on using your product as the main vehicle to acquire, activate, and retain customers. If you’ve used Slack or Dropbox, you’ve witnessed this first-hand. You didn't request a demo to have a salesperson show you how cloud-based file sharing or instant messaging could revolutionize your work. You just tried the product out yourself for free.

Wes Bush

While it’s desirable to utilize the product itself as the main vehicle to acquire, activate, and retain customers, in most B2B settings a well-educated and skilled direct Sales team is required who follow the above-sketched process, build up relationships with the customer, and create an extensive network inside and outside these organizations. Ideally, this Sales team can even provide guidance to customers in order to optimize their business processes and maximize value.

Every Enterprise Customer is Somewhat Special

Risk of Being Separated from Customers

Obviously, for any product organization, this is a no-go. The Product Management and User Research team, ideally even Engineering, have to talk to customers and prospects directly. Without any Chinese whisper, even if that is sometimes challenging. Only then is it possible to truly run Product Discovery.

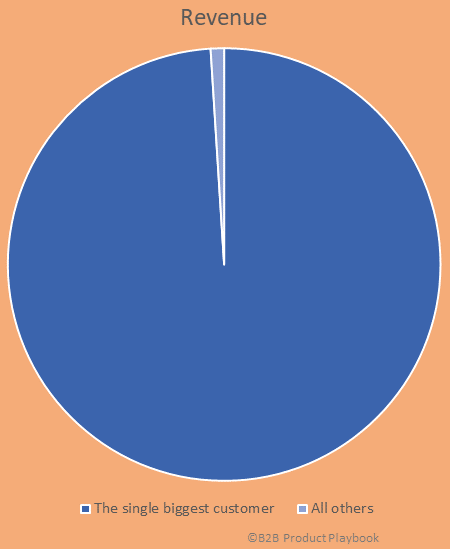

Fewer but More Valuable Users

In B2C, there is usually a huge number of users, so the value of a single individual is pretty low. In Enterprise B2B, there might only be a relatively small number of users paying significant bills, however. The bigger these enterprises are, the more demanding they might be. Expectations are much higher that their specific needs are met and while Product Management will only be able to serve some of their needs, they also can’t just say no to everything.

For Product Management, it is important to provide transparency on strategy and roadmap. What’s more, the collaboration should change from a customer demanding features to partners giving feedback and the product team providing guidance on how to achieve business objectives. Again, that requires domain expertise and thought leadership.

Having relatively few users in B2B also means that running experiments, interviewing users, and involving them in Product Discovery might become a challenge because they are getting involved too much and there is some fatigue. Even worse, these users generally don’t like change. So, even a change for the better might initially be unwanted. To handle these situations, Product Management and the User Research team should build solid relationships with individual users and also offer them some benefits, such as involvement in early access or beta programs.

False Sense of Product-Market Fit

In B2B, there might be a few paying clients, and it might even be a profitable business — but still there is no product-market fit because it may, in fact, be a service business. Growing beyond that is essential, a key indicator for product-market fit could be that product revenue (such as ARR) grows significantly faster than service revenue (respectively headcount in service).

Fewer Data, Sometimes Slow Data

In B2C, there is a large number of potential users, network effects can be exploited easily, many problems are easy to understand, and the single individual user is less relevant. For example, popular services and apps often have hundreds of millions of users. As a consequence, so-called A/B testing is both easy as well as meaningful.

By contrast, in B2B there are fewer users with typically more specific problems which might require domain expertise. Also, every single user might be a valuable stakeholder or decision-maker.

Further Reading

How B2B and B2C Product Management Differ

Product management roles vary across companies as a function of many different aspects, for example, company size, culture, or historical context. One important factor driving differences in the role of product managers is whether the product is B2B or B2C.

The Enterprise B2B Product Sales Cycle

These companies have certain characteristics. They are big and slow, can be risk averse, have lots of internal stakeholders and politics. On the other hand, they have massive reach, lots of money and are generally prepared to sign long term deals.

B2B vs. B2C vs. B2B2C

Justin Kan — former YC partner and co-founder of Twitch (B2C) and now Atrium (B2B) — published a piece titled “Why I love B2B over B2C.” My first instinct as a consumer investor was to send him an angry tweet.

My second instinct, as I’m currently doing a deep dive on the future of retail, was to map out how Justin’s arguments apply to a third, often overlooked, category: B2B2C.

What’s the Difference Between a B2C vs a B2B Product Manager?

Being a Product Manager in the B2B space is not easy.

It’s tough to find customers for interviews, there are multiple users to build for, and your customers take months to make a purchase decision.

So how do you succeed as a B2B product manager?

Is B2C and B2B Growth... the same?

Short answer: Nope.

A thorough analysis of key difference in growth metrics.